Why Informal Micro Businesses Run By Women Are Not Benefiting From E-Formalisation

“What is this Udyam Registration Certificate? Why do I need the certificate?” Kalpanaben*, who runs a saree business out of her house in Delhi, is bewildered. She has no idea that she needs the government-issued certificate that could help her avail of schemes that benefit medium and small scale enterprises (MSMEs).

An aagewan (community leader) from SEWA Bharat, a federation of women-led institutions providing economic and social support to women in the informal sector, was offering to help Kalpananben register her business on the Udyam Registration Portal using her phone. The portal, designed and marketed as a no-cost, seamless, paperless platform, offers digital solutions to help formalise informal enterprises.

“I do not have a smartphone. And my husband, who owns one, will not allow me to use my name or number on the internet,” said Kalpanaben.

However, navigating the maze of regulations and licences required for the registration of a business still remains a challenge for MSMEs, especially women microentrepreneurs, our research has found. Many, like Kalpanaben, can actually be called nano entrepreneurs because they function at a tiny scale.

Over 70% of women microentrepreners are home-based, with no distinctions between their place of residence and work. For these women, the digital solution is not a no-cost solution because accessing digital assets and infrastructure is costly for them. They face endless barriers in accessing institutional credit through scheduled commercial banks, which is the same pathway to credit adopted by the Udyam system.

Despite the informality of the nano businesses run by women, they still have to navigate different government departments – central, state, and local to get themselves registered and secure a licence for their enterprises. The complexity of this task varies between industries.

Our fieldwork across 10 Indian states – Bihar, Delhi, Gujarat, Jharkhand, Madhya Pradesh, Nagaland, Punjab, Rajasthan, Uttarakhand, and West Bengal – shows that even though the Udyam Registration Portal is positioned as a new and easier path towards formalisation, women entrepreneurs in the informal sector deal with the same barriers in the virtual world as they do in the real. Till these are addressed, they will continue to be excluded from formal credit, from competing in markets and from accessing necessary infrastructure. This means that registration through the portal, even if they can manage it, cannot provide them the support they need to grow and thrive.

“What’s the point of having another document as work proof? At the end of the day, despite a licence and all the documents in place, I still have to pay a bribe of Rs 500 to the policeman – a fine, as they call it,” said Renuben*, a street vendor in Ahmedabad, pointing to corruption among authorities.

Our research shows that women microentrepreneurs in the informal sector are constantly struggling with challenges. These are i) access to the skills and knowledge; ii) access to capital; iii) limited access to markets due to restrictive and unsafe mobility options among other reasons; iv) limited or negligible access to digital assets and digital literacy; v) and burden of unpaid domestic duties and care work which limits time available for productive work.

Gender Blocks To Growing A Business

The informal economy comprises over 90% of micro and small enterprises worldwide and more than half the global labour force. A large section of women in this sector exist in the overlapping space between own-account work (self-employment) and micro-entrepreneurship.

Enterprises exist along a whole spectrum of informality-formality. What are the markers of nano enterprises that are at the heart of our analysis? Being an Own Account Enterprises (OAE) or having less than five employees, low investment, low turnover, and lack of proper documentation are some of the many indicators. The challenge for the government lies in supporting the growth of these enterprises.

For women microentrepreneurs, the process of growth is often arduous, we saw. A percentage of unincorporated enterprises, more in urban areas than in rural areas, are registered with different agencies requiring them to navigate a plethora of government departments.

While India ranked 63rd in a list of 190 countries in Ease of Doing Business ranking in 2020, it stood 136th in ease of starting a business. This indicator measures the number of procedures, time, cost, and minimum capital requirement to start up and formally operate a small to medium-size limited liability company. This shows the maze of compliance and regulations an entrepreneur in India needs to just start a business.

An entrepreneur has to register under the Shops and Establishment Act to do business locally. To conduct interstate commerce, she has to register under the Sales Tax/VAT act which is now subsumed under the Goods and Services Tax Act. Along with this, the entrepreneur is supposed to register with departments for licences, depending on the sector they work in. These registrations are a step closer to the formalisation of enterprises, which allows access to government programmes, better markets, and institutional credit. With measures such as Udyam registration, the government is attempting to ease the compliance requirements for businesses using technological solutions.

Registration Process, Benefits

As we said, the Udyam portal is a measure to increase the ease of doing unincorporated businesses categorised as micro, small, and medium. Launched in July 2020, by September 2022, it had crossed 19 million registrations.

Every enterprise registered on the portal is given an Aadhaar-like unique registration number, the Udyam Registration Number (URN), and an Udyam Registration Certificate (URC) as proof of identity.

The Ministry of MSME defines a micro enterprise as one where the investment totals Rs 1 crore and the turnover Rs 5 crore (in small enterprises, the figures are Rs 10 crore and Rs 50 crore respectively and in medium enterprises, Rs 50 crore of investment and Rs 250 crore. Any entrepreneur or business as defined by the Ministry of MSME can register an enterprise on the portal. No enterprise can register more than once although one can add multiple activities of manufacturing and/or services. Initially, only manufacturers and service providers came under the purview of the Udyam portal. But in July 2021, an Office Memorandum was released to include traders (retail and wholesale). Eventually, in August 2021, the Ministry of MSMEs clarified that urban street vendors too can register themselves as retail traders.

The process of registering an enterprise on the Udyam portal is free, paperless (online) and self-reported, as we said. One needs a mobile-linked Aadhaar card and PAN card to register and no documents are required to be uploaded. The portal is linked with the Aadhaar database, the Income Tax portal, and the GST portal and therefore sources relevant information automatically.

If the applicant has not filed any tax returns previously, the portal encourages them to start doing so. Business assets are understood to be directly linked to the PAN card and are therefore reflected in the ITR form while filing returns. The entrepreneur also requires a bank account to register on the portal.

For enterprises, the website of Udyam Registration Portal mentions the benefits such as:

- Ability to register on the GeM portal (an E-marketplace linking the government to businesses) and the Samadhaan portal (a portal that addresses issues of delayed payments). Simultaneously the MSME can register itself on the TReDS, a platform where receivable invoices are traded

- Eligibility to access credit under priority sector lending

- Access to schemes of the Ministry of MSME such as credit guarantee schemes, public procurement policy, selection for government tenders and protection against delayed payments, etc

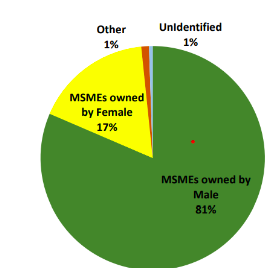

Miniscule Percentage Of Women Registered

Source: Analysis of Udyam Registration Data, Udyam Registration Bulletin V

Source: Analysis of Udyam Registration Data, Udyam Registration Bulletin V Eligibility, Accessibility, Usage

For registration, an entrepreneur faces various bureaucratic challenges including the lack of exhaustive information and navigational capital. Women-owned enterprises experience additional challenges: their very small scale does not allow them to incur the cost of registration.

Registration fees under the Shops and Establishments Act varies between states, the number of employees hired and the activity engaged in. The fees for registering a micro enterprise, ranges from Rs 0 in Punjab to Rs 5000 in Rajasthan. This is a recurring annual cost in most states. Then there are associated expenses such as bookkeeping, and the cost of filing GST returns.

Our interactions with women entrepreneurs in the informal sector showed us why they are unable to register – for instance, the lack of awareness about the process, no access to the internet, and not having a PAN card.

In 2015-2016, only 3% of women-owned MSMEs had internet access, only 4% of women-owned enterprises maintained a bank account in the name of the enterprise, and 45% maintained a bank account in their own names. These numbers show a critical gap in the access women entrepreneurs have to formal credit and digital services.

“I tried to register myself on my son’s phone. But the whole form was in English which I do not know how to read and write. So I didn’t register myself,” said Reshmaben*, who runs a grocery store out of a room in her house in Delhi. The form is only and entirely in English making it incomprehensible to a large population of women entrepreneurs.

The government runs centres under the Common Service Centres 2.0 scheme and provides assistance to those wishing to register on the Udyam portal for a charge of Rs 30. Seva Kendras for MSMEs also assist with this process but only entrepreneurs who have an annual turnover of Rs 5 lakh. This would exclude a majority of women microentrepreneurs – according to the 73rd Round NSSO, 84% of women-owned enterprises have an annual turnover of less than Rs 5 lakh. As the definition of micro enterprises by the GOI does not have a lower limit on turnover size, this conditional threshold needs to be challenged.

Registration through the portal is supposed to provide the enterprise access to credit guarantee schemes implemented by scheduled commercial banks. The minimum requirements of accessing credit facilities through these scheduled commercial banks are i) an annual bank statement of the current account of the enterprise and ii) ITRs of a minimum of 3 years. The remaining requirements differ from bank to bank and enterprise to enterprise. As mentioned, data indicates that only 4% of women-owned enterprises have a bank account in the enterprise name. According to the BSR-2 Annual Survey 2020-2021 by the RBI, women as proprietors hold 16% of the total current accounts in their name.

Until recently, to open a current account with a scheduled commercial bank, the entrepreneur required business operation proof in the form of a registration certificate with local municipal authorities or a GST registration certificate; both of which are costly endeavours (the expense one has to incur on bookeeping and filing of monthly GST returns depends on the fee charged by the chartered accountant hired by the entrepreneur). With the launch of the Udyam portal, public sector banks now allow entrepreneurs to open a current account using the certificate issued by the portal. But opening a current account does not guarantee credit access for women micro entrepreneurs because of other eligibility requirements.

When an entrepreneur registers their enterprise with local municipal offices under the Shops and Establishments Act, the address at which the individual is registering their enterprise automatically becomes a commercial space and attracts a property tax of a commercial space. For many women who work out of their residences, this is an undue burden. Moreover, most informal women workers and their families live in informal settlements on rent or in spaces that may not always allow for non-residential uses of land, making them more vulnerable to scrutiny and displacement.

*Names changed for privacy.

We believe everyone deserves equal access to accurate news. Support from our readers enables us to keep our journalism open and free for everyone, all over the world.